This method is applicable when individual items can be clearly identified, such as with a serial number, stamped receipt date, bar code, or RFID tag. The cost of ending inventory under specific identification is the sum of all the costs assigned to each inventory item, such as accumulated cost of Unit A, Unit B, and so on, that haven’t yet been sold. Because costs are assigned to specific units of inventory, no cost flow assumption is required, and it’s simple to identify the costs remaining in ending inventory.

- He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own.

- For example, a car dealer sold a 2021 Ford Explorer with a vehicle identification number (VIN) ending 3716.

- The specific identification method is used to track individual items of inventory.

- Assume the supplier offers “free shipping” which actually means the shipping costs are built into the price the vendor is charging NewCo.

Requirements of Specific Identification Accounting System

In short, I would like to say that specific identification accounting is one of the most important tools used for the valuation of a company’s inventory. In this method, each stock item is tracked in association with its respective costs. It can be used to calculate critical items like closing stock and the cost of goods sold. This method helps to understand at which stage the inventory item is and how much revenue is received from the sales of that particular item.

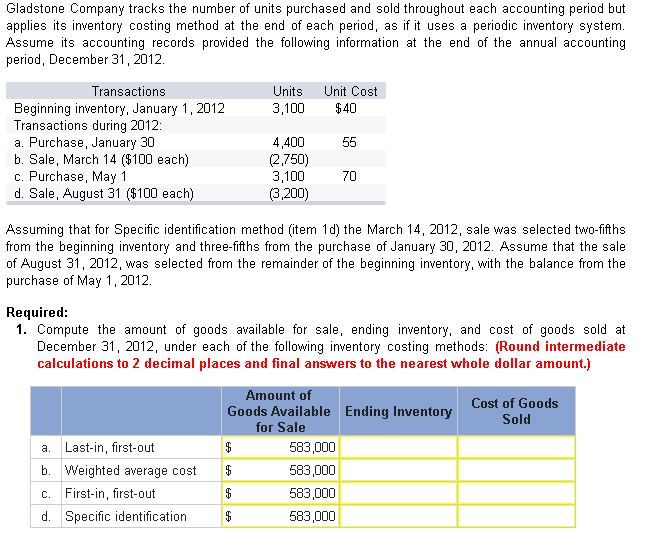

How To Calculate Ending Inventory Using the Specific Identification Method

The store uses specific identification to value its inventory by recording the exact price paid for each camera. Hence, you just need to add their individual costs to compute COGS. The company also paid for $1,200 shipping costs and $750 insurance. During the month, an agent sold SUV 0003 for $47,950, and another agent sold SUV 0001 for $52,500.

FIFO Vs. Specific Identification Accounting Methods

As usual, we prepare the journal entry and post it to both the GL and the subsidiary ledger. On the 29th of October, NewCo sold six bats from the ones purchased on the 15th, and so assigned those bats a $10 cost each. Yes, it directly affects the cost of goods sold and inventory values on financial statements. No, it’s best suited for items that are not identical and can be separately identified.

Each car has a different dealer cost and a different sales price based on the model and its features. Each of the cars is tracked individually from the time they enter the lot until they are sold. A company that might use the specific identification method would be a business that sells fine watches or an art gallery. These requirements can be followed with a simple accounting system, such a spreadsheet. The specific identification accounting method is best used for small business with low unit volumes. The total purchases of ABC Dealership for the SUVs is $138,515 ($44,235 + $45,030 + $47,300 + $1,200 + $750).

This guide discusses how the specific identification inventory method works, who it’s optimal for, its highlights and drawbacks, and how to calculate ending inventory and COGS using it. It is equally important to understand the disadvantages of specific identification method stock sales. By default, the IRS, brokerage firms, and most trade accounting programs use the First-In- First-Out (FIFO) accounting method for securities. If you sell security A, its cost-basis is the first lot purchased — the first one “out” or sold. Enables precise COGS calculation by tracking individual item costs. Retailers order tons of inventory from wholesalers and manufacturers on a regular basis.

Let’s assume we’ve not lost any to “shrinkage” (breakage, customer theft, or employee theft) and that our perpetual records match our physical count. The disadvantages of specific identification methods are as follows. This system is extremely accurate because each piece of inventory can be tracked separately. There are no estimates involved which make the inventory and cost of goods sold numbers more accurate on the financial statements as well. Moving forward, let’s explore both sides—the advantages and challenges—of using the specific identification method in business operations. Tracking the cost of each item is crucial for businesses managing expensive equipment.

Match cost to sales – This is done while calculating the COGS the cost and revenue is matched for each product. The ending inventory is calculated by adding up the same at the end of the accounting period. Mr. Green’s role in GNM was to render tax consultation services to traders. Mr. Green what is a favorable variance what it means for your small business is a leading authority on trader tax and a Forbes contributor. He is also the author of The Tax Guide for Traders (McGraw-Hill, 2004) and Green’s annual Trader Tax Guide. Mr. Green is frequently interviewed and has appeared in the New York Times, Wall Street Journal, Forbes, and Barron’s.

Congrats on reading the definition of specific identification method. Most businesses sell products that are essentially interchangeable and more like use systems like FIFO, LIFO and weighted average. Examples of situations in which the specific identification method would be applicable are a purveyor of fine watches or an art gallery. You must specify the lot to sell before executing the sale, and the broker must confirm those instructions in writing at that same time.